Portfolio focus pays off for Coca-Cola

It was interesting to watch Coca-Cola CEO James Quincy talk about portfolio focus in a CNN interview (1), one year after we posted here on his plans to cut a large number of “zombie brands”. His strategy was to cull small, slow growing brands that eat up resource to focus on the biggest, most profitable opportunities. (Thanks to James Black for the tip off on Linked In). In this post, I refresh some of the key points from the post.

In terms of results, early signs are that the portfolio strategy is paying off. Or, at least, the drastic culling of secondary brands has not harmed sales. Net revenues grew +16% to $10.0 billion in the latest quarter (2). Importantly, the company reported that “third quarter volume was ahead of 2019“, suggesting that this growth was more than just a post-lockdown rebound.

1. Follow the money

A common mistake at Coca-Cola in the past was managers having an emotional connection to brands that were small in sales terms.

Quincy reiterated in his CNN interview the need to objectively review brand assets. A key part of any brandgym portfolio strategy project is urging the team to do just this by “following the money”.

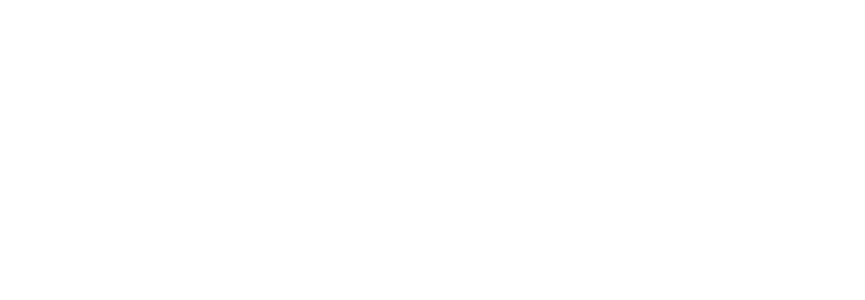

When Coca-Cola followed the money they found that HALF of the company’s 400 brands were small local country brands accounting for only 2% of the company’s sales! It was this long tail of 200 small brands that were in Quincy’s firing line.

2. Turn a crisis into an opportunity

One interesting insight from the new interview was how Quincy used the crisis created by the pandemic as an opportunity to re-shape the business in Q2 of 2020. He knew the business was going to suffer as the world closed down or locked down. So this presented an opportunity to push through drastic changes which might have been harder to do when business was on the up. “We didn’t want to just manage through the crisis. We wanted to come out stronger,” he told CNN (1).

3. ‘Sunset’ your smaller brands

Coca-Cola has proceeded with its plans to cut the smaller brands in the portfolio and redirect resources to brands with better growth opportunities. This includes some high profile casualties such as the Tab brand.

It was interesting to see how Quincy has softened his language, maybe to smooth the process of portfolio focus. He no longer talks about killing zombies. Instead, he refers to “sunsetting” brands, which sounds like sending them off to a retirement home!

4. Focus energy on high growth brands

Importantly, portfolio focus doesn’t mean reducing renovation of innovation. Instead, the objective is to drive focus on fewer brands to increase both efficiency and effectiveness. In his latest interview Quincy describes smaller brands as “furring up the arteries” of the Coca-Cola organisation and slowing it down.

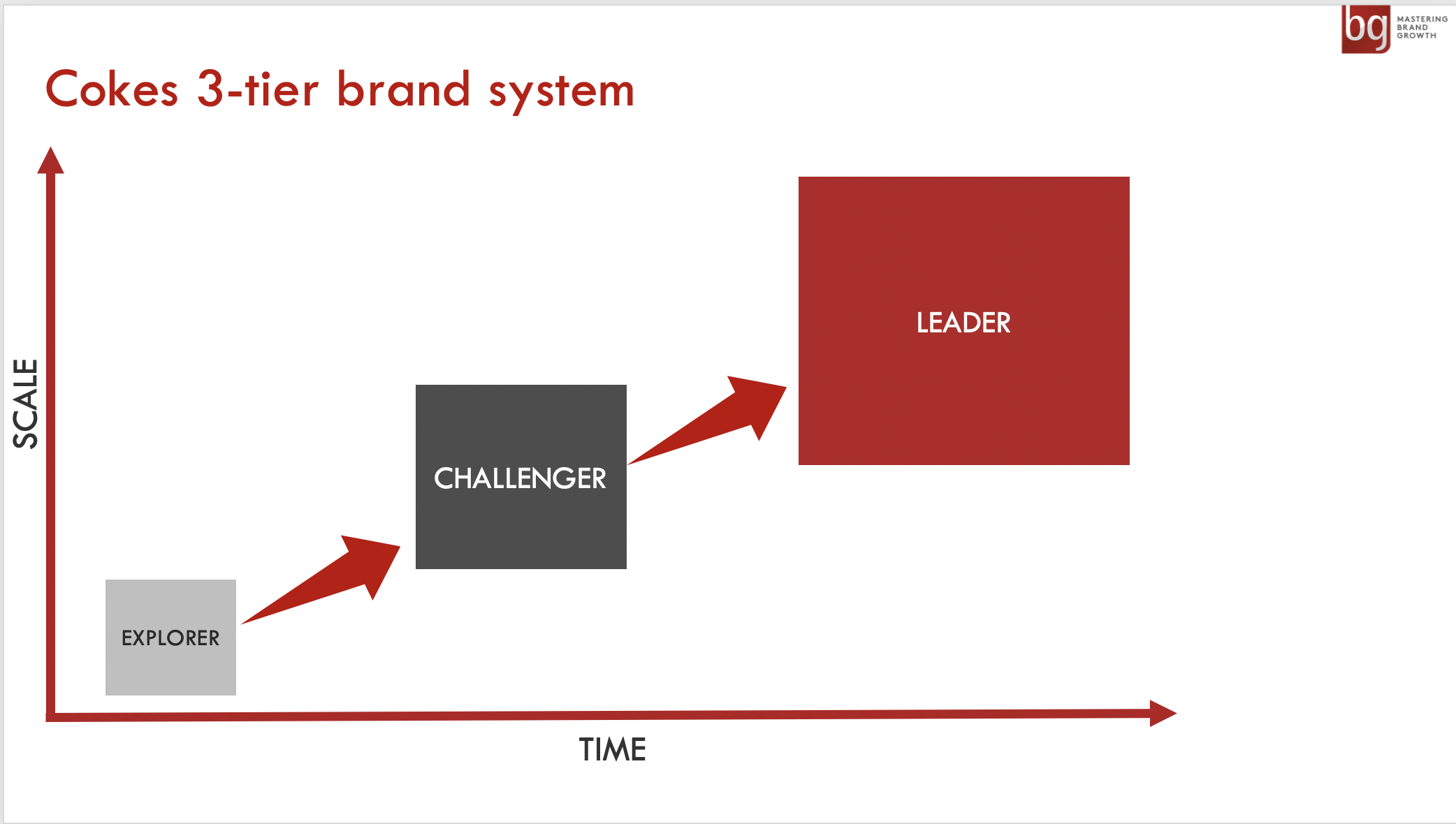

The future strategy is to focus on brand that fall into one of three tiers Coca-Cola designed in 2019:

- Explorer: category disruptors, very fast growth, gaining a core of consumers

- Challenger: gaining market share with potential to get to leadership

- Leader: leading positions with scale and more favourable margins.

Importantly, this system clarifies that its OK for a brand to be small, provided that it has the potential to grow. This requires a process to measure the ‘momentum’ of a brand to assess how fast it is growing in terms of sales, but also awareness and ‘buzz’, such as social media mentions.

5. Blend “big bets” and “intelligent experimentation”

“The company is building a strong innovation pipeline that leverages big bets as well as intelligent experimentation,” according to it latest quarterly results. update. Examples of this approach include:

- Big bets: the scaled launch of new, improved Coca‑Cola Zero Sugar resulted in improved consumer metrics and drove c.25% of the Coca‑Cola brand’s growth in the third quarter

- Intelligent experimentation: local market level experimentation included launching Aquarius plus functional benefits

6. “Shift and lift” regional brands

Coca-Cola also leveraging its global network to “lift and shift” local and regional brands to additional markets around the world. A good example is expanding Costa® ready-to-drink coffee from the UK, launching in the key markets of Japan and China.

In conclusion, one year on the ruthless portfolio focus launched by James Quincy back in 2020 seems to be starting to pay off. This shows the benefit of following the money to concentrate financial and human resources on fewer, bigger opportunities.

We explore portfolio strategy in detail as one of the key modules on our brandgym Mastering Brand Growth program. You can check out the next program and book places on our brandgym Academy platform here.

Sources