Innovate faster & cheaper to beat ‘the innovation squeeze’: brandgym research part 1

Our 12th annual research project focuses on the hot topic of innovation. In this first of two posts we look at the relationship between innovation and cost cutting: have big brands focused less on innovation and more on cost cutting as many new headlines suggest, such as those reporting Kraft Heinz’s $12.6bn loss in 2018?

We then look at the time taken to get from ideas to business approval, following up on last year’s research, Big Brands Under Attack, which showed that slowness of innovation was a key weakness for big brands. We explore two key aspects of delivering fast and cost-effective innovation: i. which insight techniques marketing teams are using and ii. effectiveness at pitching a convincing business case for innovation to senior management.

A second post will suggest a new approach to innovation to help make it faster and cheaper.

1.The ‘innovation squeeze’

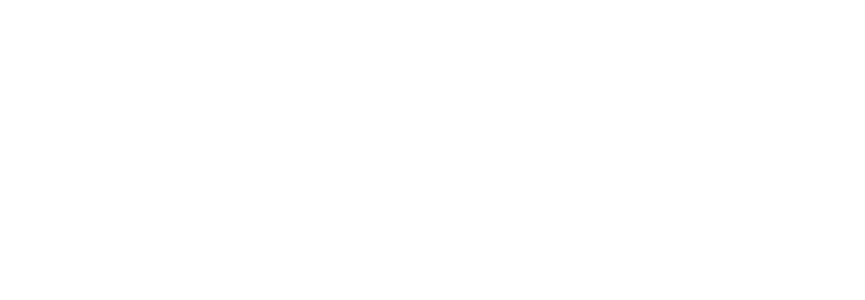

Our research reveals that rather than reducing innovation and focussing on cost cutting, marketing leaders today are facing demands to deliver on both fronts at the same time. Demands to deliver rapid innovation for topline growth have increased for the majority. For example, Unilever’s new CEO Alan Jope has committed to organic growth of 3-5%, with innovation playing a key role.

At the same time, most marketers (72%) have also faced increased pressure to cut costs. Unilever is cutting costs to boost margins (target of +2.5% pts by 2020), in addition to its topline objective, prompted by the attempted takeover by 3G Capital’s Kraft Heinz.

Many marketers are struggling to deliver the dual objectives of what we call the ‘innovation squeeze’ because, as we see next, they still rely on slow, expensive and time-consuming innovation processes.

2. Innovation is taking too long

Almost 40% of respondents are taking one-two years or more to get from the start of an innovation project to business approval (not even in-market) takes. This seems slow, especially compared to smaller insurgent brands using rapid response to trends as a source of advantage, as shown in last year’s paper, Big Brands Under Attack. For example, Mexican food brand Gran Luchito took only 8 weeks to get their new Refried Beans from idea onto Sainsbury’s shelves.

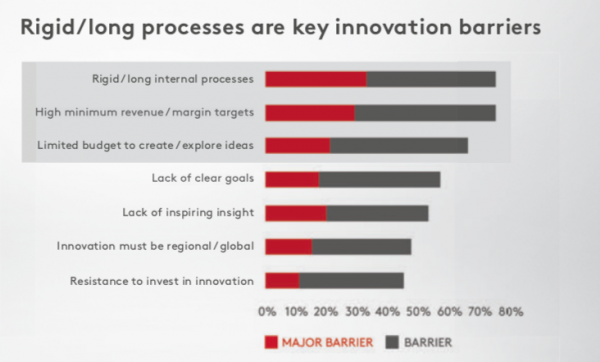

The main barriers slowing down innovation are rigid, lengthy internal processes coupled with high minimum revenue targets. And despite all the talk of ‘agile’ marketing, only 1⁄2 of respondents rapidly explore rough ideas to ‘test & learn’. Limited budget to create & explore ideas is one explanation for this.

3. Reliance on slow, expensive quant research …

Long and rigid innovation processes reflect a reliance on conventional quantitative research, which remains one of the most commonly used insight techniques, despite being seen as both expensive and slow. The popular pre-market BASES test, for example, typically requires $100k+ and 12 weeks for a full test. Progressive marketers are using faster, real-life evaluation, such as ‘soft launching’ new products in eCommerce, in addition to cheaper, quicker quant such as overnight mobile surveys.

4. …neglecting effective insight fuel

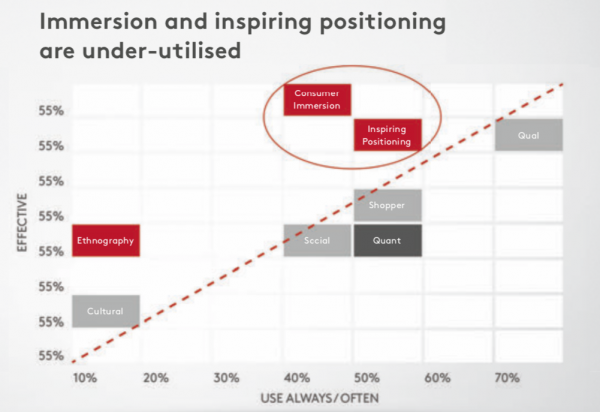

Harnessing an inspiring brand positioning, consumer immersion and ethnography are highly effective forms of ‘insight fuel’ that are relatively under-used (by 42%, 55% and 10% respectively), meaning that many companies are missing out on opportunities to solve the innovation squeeze:

- Consumer immersion is rapid and cost effective, if properly designed and managed.

- Ethnographic studies to observe consumers ‘in-situ’ can now be done cost-effectively and rapidly using mobile-enabled video studies.

- Well-run brands should have an inspiring positioning to ensure innovation is brand-led, not product-led, although findings here confirm previous brandgym research showing that brand positioning today is being neglected.

5.Show them the money

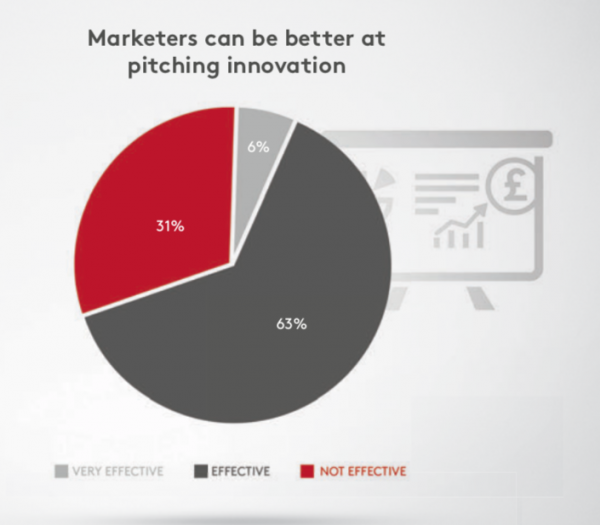

Marketers’ ability to ‘pitch’ & sell new innovation ideas to senior management was confirmed as important by 94% of respondents. Making a convincing business case can speed up the innovation process by reducing the number of meetings needed with senior management, and also reducing reliance on rounds of slow and expensive quantitative validation.

However, only 6% of respondents rated marketers as very effective at this critical part of the innovation process, with 31% rating them as not effective. The need to make growth cases more convincing is confirmed by McKinsey research with CFOs: 45% said marketing proposals had been declined or not fully funded because they didn’t demonstrate “a clear line to value.”

In conclusion, accelerating the process of getting from ideas to business approval can help companies solve the innovation squeeze. Key ways for markers to do this include using quicker, lighter, inspiring insight methods, and raising their game when pitching innovation ideas to management, combining business savviness with inspiration to win approval fast, saving time and money.