I’m a big believer in the power of brand portfolio strategy. It’s one of the key topics in our brandgym Mastering Brand Growth program on our brandgym Academy online training platform.

An interesting HBR article on using brand portfolio strategy to focus a business popped into my Twitter feed (thanks @ahmeddarwish ). The article by Nirmalya Kumar, “Kill a Brand, Keep a Customer”, is quite old, but the key point is still relevant today. Nirmalya suggests that “companies have boosted profits by deleting loss-making brands but also declining, weak, and marginally profitable brands.“

Rationalising your brand portfolio can create economies of scale, by reducing complexity for the factory and the sales force. Just as important are “economies of ideas”. With a streamlined portfolio, your company can focus time, money and energy on fewer, bigger and stronger brands. Its about ‘return on talent’ (ROT), not just return on investment (ROI). For example, Unilever reduced its portfolio from 1,200 to 750 brands between 1999 and 2002. The top 400 brands accounted for 90% of sales in 2002 compared to 75% in 1999, and had higher growth (5.4%) versus the company as a whole (4.2%).

I look below at some practical ways to focus your brand portfolio strategy as Nirmalya recommends.

Need versus Feed

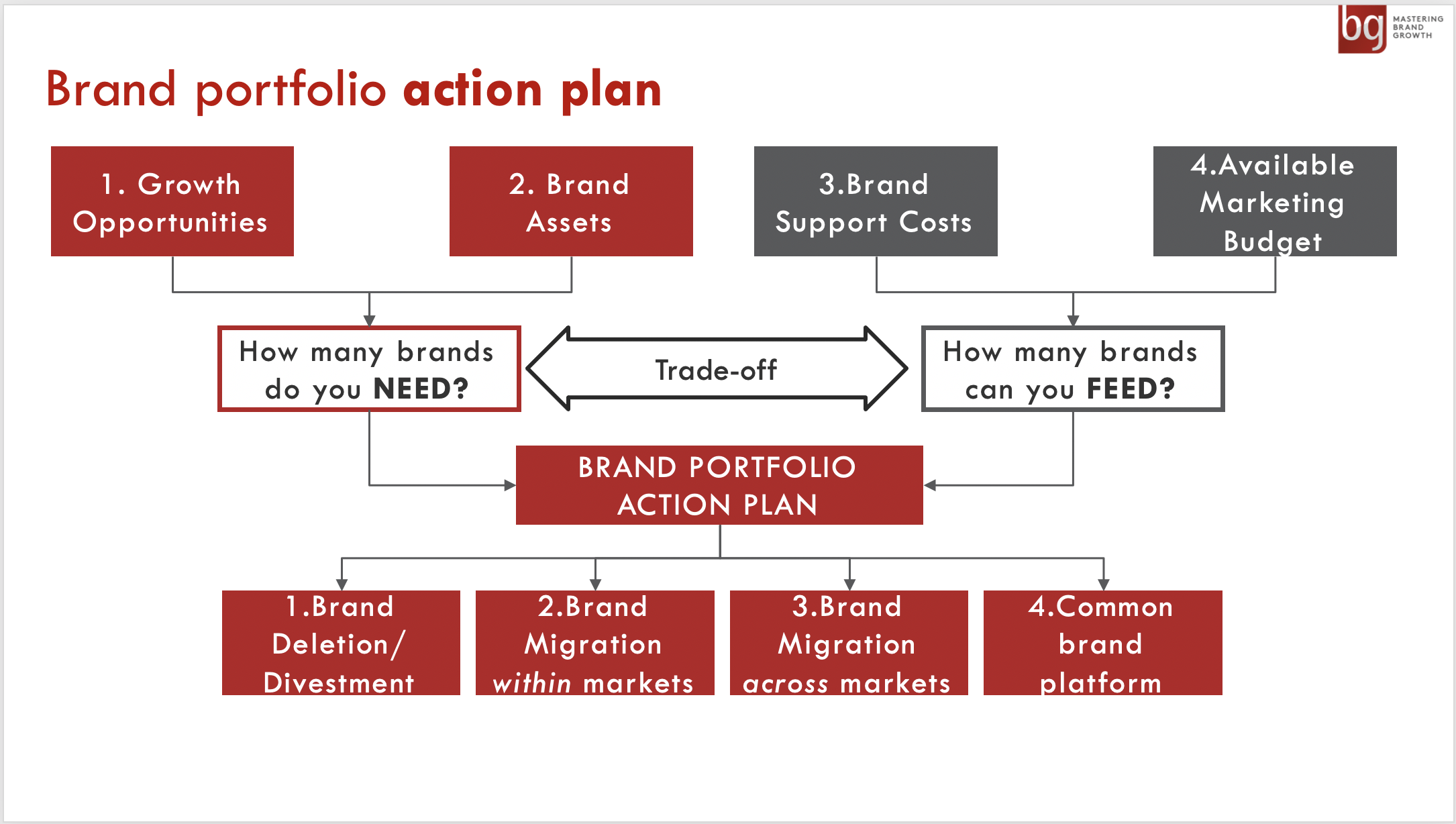

We start brand portfolio strategy projects by looking at the trade off between the number of brands you need, and how many you can feed:

- NEED: before launching into discussions about which brands to keep or kill, step back and look at consumers needs. What are the key needs, occasions and consumer groups you are targeting? And how well are you covering these growth opportunities with the brands in your portfolio? You may find overlap, where multiple brands are targeting the same occasion or need state. Or, you may highlight underlap where you no brand is present.

- FEED: balance the ideal number of brands in the portfolio with some business reality. What are the available resources in the business, and how much does it cost to support a brand at low, medium and high levels of investment?

The strategy should also lead to recommendations on how to focus your portfolio, with four key routes to growth, as detailed below.

1. Brand Disposal

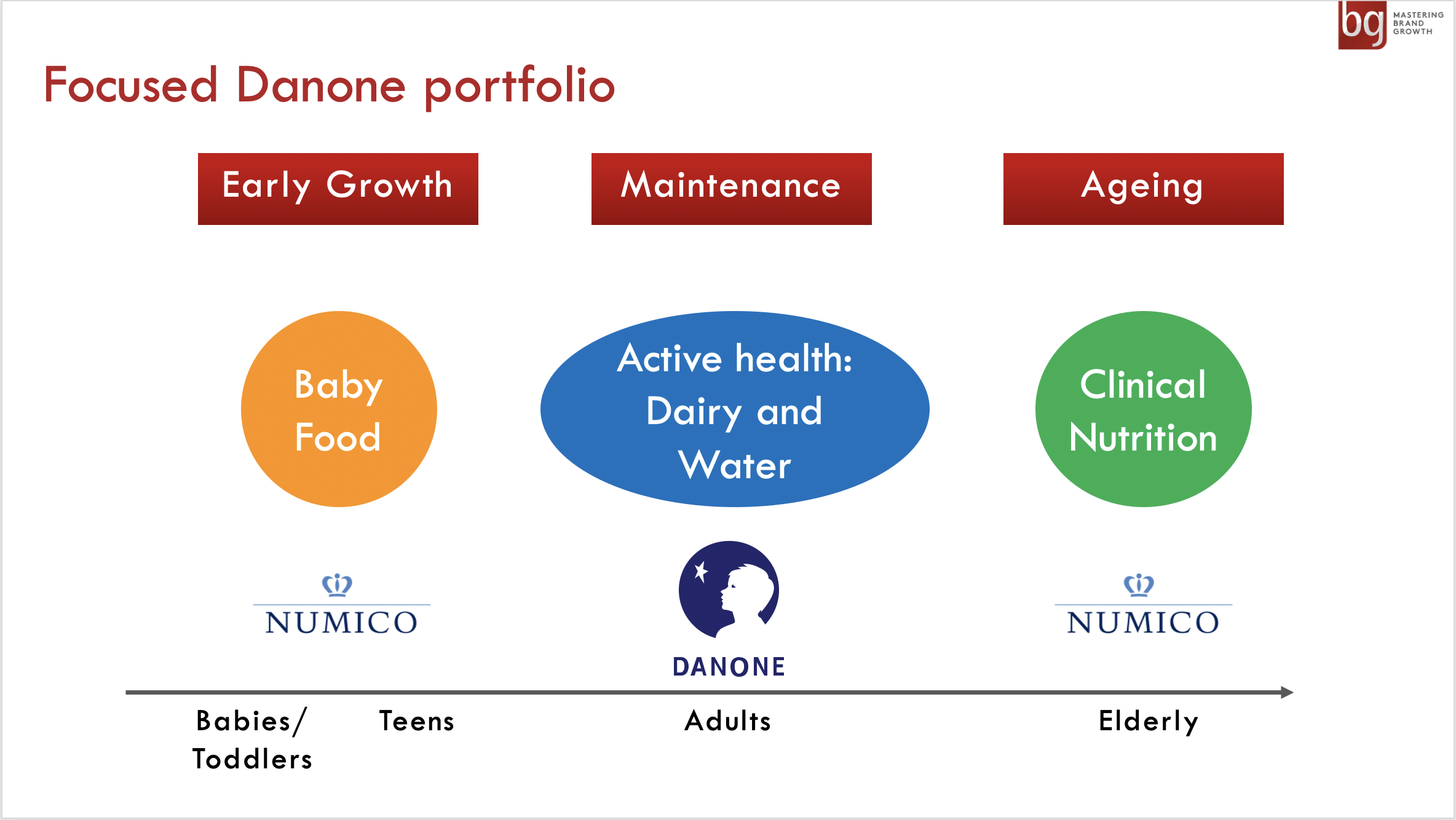

Smart companies focus their brand portfolio strategy by selling off brands that don’t fit with their corporate strategy. This focus is driven partly by a move to concentrate on higher growth categories. But just as important is a focus on the company’s “core competences”, the areas where it want to build and leverage expertise. I posted here about Danone’s portfolio pruning which saw the sell-off of a raft of companies over a six year period, as summarised below:

– 1997 – pasta, sauce and soup brands (Panzani)

– 1999 – frozen and chilled ready meals (Marie Surgeles)

– 1999 – Container activities

– 2000 – Kronenbourg beer and share in San Miguel beer

– 2002 – Italian cheese and ham (Galbani)

– 2004 – British biscuits (United Biscuits)

– 2005 – HP Foods

This allowed Danone to focus on health, with a range of products that go from babies, through infants to adults and then people in later life.

2. Brand migration WITHIN markets

A second way to focus your brand portfolio strategy is to migrate brands within a market. For example, Unilever re-branded Radion laundry detergent as Surf SunFresh. This followed research showing that Radion was associated with a fresh fragrance that fitted well with Surf’s positioning about the pleasurable side of laundry. After six months, the new enlarged Surf brand’s 8% market share was equal to the old Surf and Radion brands combined. The share was now all under one bigger brand, with the new product strengthening the Surf proposition. Another more recent example is the migration of Orange and T-Mobile into the EE brand in the UK mobile network market, as I posted on here.

3. Brand migration ACROSS markets

Brand migration can also take place across markets. This allows a company to focus global resources on a single brand, rather than fragmenting effort across a series of local brands. Mars was a pioneer in this area, re-branding the UK Marathon brand as Snickers, for example. Mars set the template for this form of brand migration, with the local brand adopting the global brand look and feel and flagging the impending change, prior to the change of branding.

This approach has been followed by many companies, with a recent example being Telenor’s migration of the Indian brand Uninor, first adopting the global Telenor brand identity, and now moving to the Telenor name itself, as reported here.

4. Common brand platform

Brand migration and deletion comes with serious risks, not just benefits. Local brands may have strong recognition and equity after many years of marketing support. An alternative approach is to create a common “brand platform”, whilst maintaining local brand names. This hybrid approach has been used with some success by Unilever.

Back in the early 00’s, we helped the global laundry team create a common global brand vision for what was at the time a hotch-potch of brands with the rather uninspiring internal name “Top Clean”. The team identified a positioning with global relevance around the idea of giving kids “freedom to get dirty”, summed up with the tagline “Dirt is Good”, or DIG for short. This inspiring global brand vision led to the creation of a common brand identity, called “the splat”, the appointment of a global agency, BBH, and a rationalisation of product formulations. Fifteen years on from that the first global brand worksop I facilitated, the DIG brand is truly global and held up as one Unilever’s strongest “brands”, even though it still operates under different brand names.

In conclusion, Nirmalya Kumar’s article still rings true today, a timely reminder of the benefits of focusing your brand portfolio strategy on fewer, bigger, better brands.

We explore brand portfolio strategy in depth on our brandgym Mastering Brand Growth program. If you’d like more info on the program, simply pop your name and email in the form below (we’ll also send you the weekly brandgym blog email and brandgym Academy news, but you can opt out at any time).

To further explore brand portfolio strategy, you might want to look at these other blog posts: