The recent brand stretch of Mr Kipling* from cakes into ice cream caught my attention on Linked In. The new product has been launched exclusively in the Iceland store chain. “Can the Mr Kipling brand stretch into the ice cream market?” seems to be the focus of the many comments on the Linked In post. And most people commenting answered this question positively. “Extending into an adjacent category with a product line-up that suits both the new category and the original brand seems intuitively a winning proposition,” commented one marketer, for example. “Great innovation,” added another.

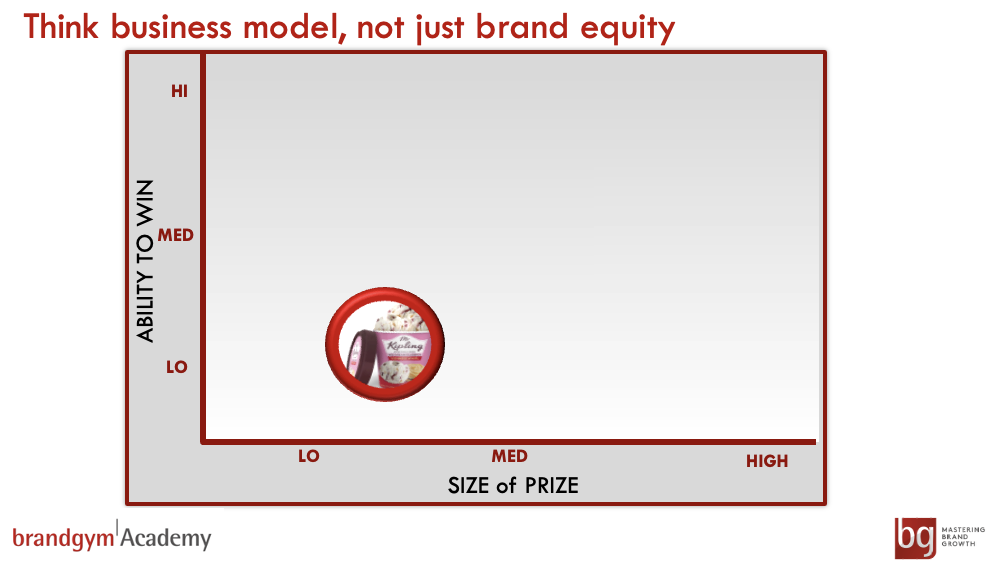

However, I suggest a better question to ask is, “Can Mr Kipling make any money from stretching into the ice cream market?”. And to help answer this question, we’ll use a simple framework we use on brandgym projects and on the the brandgym Mastering Brand Growth Program.

The data used is what I could find in the public domain using my own research. I would love to hear from anyone at Premier Foods or Iceland with more accurate data and will update this post if I do get any information!

*For non-UK readers, Mr Kipling sell ambient, traditional, packaged cakes with British delicacies such as Cherry Bakewell tarts and French Fancies

1.SIZE OF PRIZE

The first thing to assess on any brand stretch initiative is the size of the prize. To do this, we look at 1. market attractiveness (size, growth and competitive intensity), 2. concept appeal and 3. product delivery.

The UK take-home ice cream market is pretty big at c. £1.3billion, according to Kantar. The market grew +20% during the lockdowns of 2020 and more slowly in 2021 at +2% (1). Given pricing of £3.50 per 475ml tub in line with Ben & Jerry’s in Iceland, Mr Kipling seems to be competing in the ‘premium/luxury desert’ category, which is worth c. £430million. However, Mr Kipling ice cream is only sold in Iceland, who account for 6.7% of UK ice cream. So, this would make the available market a much smaller c.£30million.

The concept does look distinctive, with the ice cream including swirls of Mr Kipling cake pieces. Mr Kipling does have some relevant brand attributes that could add value in the category, such as taste, texture and nostalgia. And the packaging does look attractive, using the burgundy colours that Häagen-Dazs had before its design change.

In terms of product delivery, consumer reviews on Iceland are a mixed bag. They range from a low 3.5* for French Fancy, to an OK 4* for Veinnese Whirl and a good 4.5* for Chocolate Slice, equal to Ben & Jerry’s Cookie Dough.

Where Mr Kipling might struggle is on Competitive intensity. This looks high, with Mr Kipling up against two powerful brands in Ben & Jerry’s and Häagen-Dazs. These two have combined sales of c. £200million and years of brand building under their belts. And, as mentioned, Mr Kipling is priced in line with Ben & Jerry’s in Iceland.

Assuming Mr Kipling got a 10% share of premium/luxury ice cream in Iceland, this would make it a c.£3million opportunity. Given total brand sales reported as c. £150million (2), this equates to c. 2% growth, which I’d classify as small. The upside is that the growth is all incremental, given the brand is stretching to a new category.

SIZE OF PRIZE: LOW to MEDIUM

2.ABILITY to WIN

Marketers tend to be pretty good at estimating the size of prize for brand stretching. Where they often fall down is on assessing ability to win. Not one of the 35 comments on the Linked In post referred to this aspect of brand stretch assessment.

First, we consider whether a company has the capabilities to actually make and distribute the new product. Parent company Premier Foods is an ambient food manufacturer, with no frozen food capabilities as far as I know.

Second, is there opportunity for scale economies and cost advantage. Here, there is some potential, given that Premier Foods has also launched ice creams under its Angel Delight and Ambrosia brands.

Finally, we need to assess the ability to invest in the new product for the long run, not just at launch. Here, Mr Kipling seems to score low. There appears to be no planned above the line support. And the new ice cream product does not even feature on the brand’s website.

ABILITY to WIN: LOW

3. ASSESSING as a TACTICAL OFFER

As strategic stretch, Mr Kipling Ice Cream looks like it has low potential to succeed (see below)

But on reflection, maybe this is not a strategic brand stretch at all? Rather, it is what I call a LET-OFF: a Limited Edition Tactical OFFer. The product is only sold in Iceland. And my guess that the product is made by Iceland under licence, given Premier Foods’ lack of frozen food capability. Assuming a 10-15% licensing fee, this means Mr Kipling Ice Cream is likely to be an even smaller £300,000 to £450,000 business opportunity. So, how to evaluate it?

I use three key criteria for assessing LET-OFFs. Using these, Tropicana’s Toothpaste launch scored a lowly 3/10, as I posted on here. How does Mr Kipling Ice Cream fare.

REACH: how effective is the idea at creating “buzz” and social sharing to drive brand reach and in turn penetration, key to brand growth?

=> The Mr Kipling ice cream launch seems to have got pretty good news coverage, including a feature on the Sun.com , read by 30million people per month (Score 4 out of 4)

REINFORCEMENT: how effective is the idea at reinforcing the brand’s core benefits?

=> The ice cream does a nice job of reinforcing taste, texture and enjoyment credentials. And premium pricing in line with Ben & Jerry’s in Iceland adds a bit of everyday aspiration to what is a mainstream brand (Score out of 4)

REJUVENATION: how effective is the idea at rejuvenating the brand by bringing freshness and popular cultural “currency”

=> Launching a long-established classic brand like Mr Kipling into a new, premium category feels like it adds freshness and topicality. “Three of the nation’s favourites, iconic cakes have been used to inspire three delicious sounding new ice creams and we just don’t know which we want to try first!” reported Good Housekeeping (4), for example (Score 4/4)

TOTAL SCORE as a LET-OFF: 10 out of 10!

4. CONSIDER ROT (RETURN ON TALENT), not JUST ROI

Based on the above, Mr Kipling ice cream is a smart tactical move. It has potential to drive brand awareness. And it could be generating some licensing fees that can be re-invested on the core cakes business.

These potential returns do need to be assesses against the investment made. With LET-OFFs the question here is less to do with return on investment (ROI). Instead, the question is more to do with return on TALENT (ROT). Assuming I am right and Iceland have created and produced the Mr Kipling ice cream, the Premier Foods team will have had to invest time in helping create the concept and reviewing the marketing mix, including the product and pack.

Given the positive potential for reach, reinforcement and rejuvenation, the ROT in this case looks good. Whereas for Tropicana toothpaste it looked much less convincing.

Net, full marks to the Mr Kipling team and Iceland for creating a brand stretch that generates sales for the retailer, licensing fees for Premier Foods (assuming I’m right on that) and reach for the brand.

We explore brand stretch alongside seven other modules on our brandgm Mastering Brand Growth program, a practical and comprehensive approach to create brand that inspires business growth. You can sign up to the next program or find out more by clicking HERE

We also offer a brandgym Academy short course on Brand Stretch here. This short course is only £95+VAT, refundable if you on to do the full Mastering Brand Growth program.

And to further explore brand stretch, see this earlier post.

SOURCES: