Facebook founder Mark Zukerberg’s ‘pivot’ to put all his eggs in the metaverse* basket hit the headlines this week, for the wrong reasons. “Zuckerberg’s bet on the metaverse grows riskier,” reported The FT (1). “Reality bites in Zuckerberg’s virtual mission,” said The Times (2). In this post, I re-visit last November’s blog on Facebook’s name change to Meta, to see how our predictions have panned out.

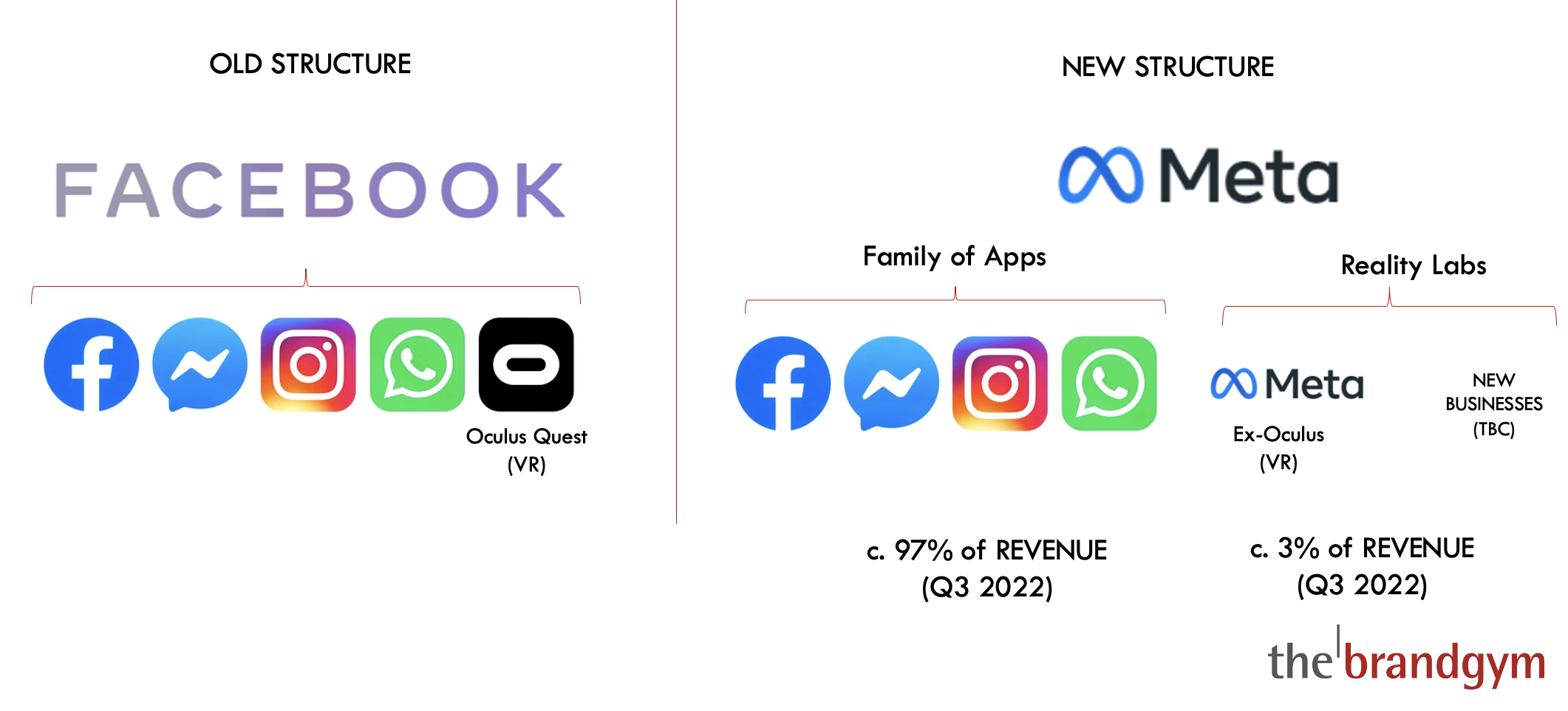

As a re-cap, the Meta name change reflected moving focus away from the core apps business (Facebook, Instagram, WhatsApp) onto the nascent metaverse. “We’re going to be metaverse first, not Facebook first,” declared Zuckerberg (1).

*“What’s the metaverse?!” you may ask. Good question. And one for which there is no clear answer. “The metaverse will feel like a hybrid of today’s online social experiences, sometimes expanded into three dimensions or projected into the physical world,” is how Meta explains it. “Moving beyond 2D screens toward immersive experiences like augmented and virtual reality.”(3) My attempt to illustrate it is watching a sports match through a virtual reality headset, where my avatar is sat next to those of my mates. Not only will watching the match be almost as good as in real life, me and my buddies can chat, have a virtual beer and exchange high fives when Harlequins score a try!

Losing focus on the core

November 2021 Post:

Last year, I wrote “My concern is the single-minded focus on the nascent metaverse offer, at a time when the core social media apps are in need of revitalisation.” I worried that “Zuckerberg’s attention seems to be on ‘the new toys’ in his massive empire, as shown by the company name change and his spending plans.” I showed how the company was moving focus onto a new division that accounted for less than 2% of current revenue (see below) and lost $10.2 billion in 2021, compared to a profit of $56.9 billion for the core business.

October 22 Update:

It seems that today I am not the only one who feels Facebook, now Meta, has lost focus.“The challenge is that they’re so metaverse focused that they’re not investing in the core product that is Facebook and Instagram,” said LightShed Partners analyst Rich Greenfield in the FT (1). “The metaverse as Meta envisions it is not investable today. Nobody is buying Meta for the metaverse”.

Cumulative losses for the Reality Labs division are now $27 billion. And the stock market as a whole has some serious doubts about the metaverse-focused strategy. Since the reorganisation and accompanying name change, Meta’s valuation has declined -40% from $1 trillion to $600billion. To be fair, some of this $400 billion of value destruction was caused by the changes to Apple’s privacy policies, which made it harder for Meta to generate ad revenue.

People inside the Meta business also seem to share my concerns about a loss of focus on the core. “The recent restructuring and ditching of various projects in order to prioritise the metaverse has knocked morale, according to multiple current and former staffers,” reported the FT (1).

Competitive threat to the core

November 2021 Post:

In last year’s post I warned of the competitive threat’s to Meta’s core business. ”Tik Tok is in the ascendancy. It had double Facebook’s downloads in the US in Q2 2020 (4) and Tik Tok was the favourite social platform for 29% of US teens in 2020, 14x Facebook at just 2% (5).”

October 22 Update:

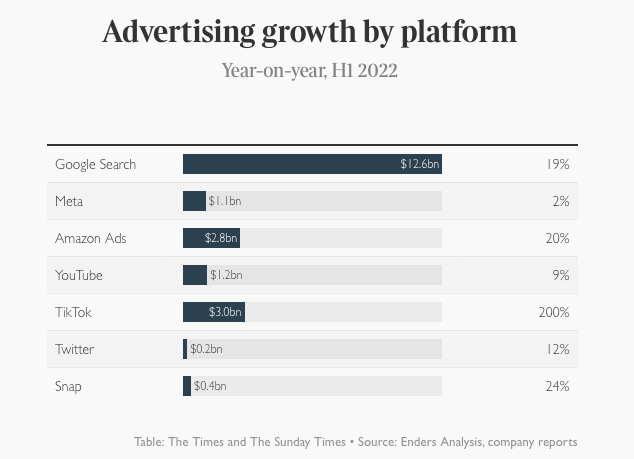

Wind forward a year and Meta has indeed lost ground against the competition. “All of this (metaverse activity) is a side show from the real issue which is that Meta continues to get its clock cleaned by TikTok,” Rich Greenfield went on to say in the FT article mentioned ealier (1). Meta’s advertising revenue grew a measly 2% in the first half of 2022, 1/100 the level achieved by Tik Tok and also lagging well behind YouTube, Google and even Twitter.

Lots of ‘sizzle’. What about the ‘sausage’?

November 2021 Post:

In the previous post I described challenges with creating a product ‘sausage’ that lived up to the ‘sizzle’ of hype. I explained how “The Oculus Quest virtual reality product (now re-named Meta Quest) had been a tougher sell than expected, as virtual reality has only incrementally gained traction among non-gamers“. I also referred to the much heralded and hyped Second Life virtual reality world, launched 20 years ago with predictions that one billion people would live life via their Second Life avatars. Regular users declined from c. one million in 2013 to between 800,000 and 900,000 by 2017 (8).

October 22 Update:

One year on from my first post, Meta is not close to having even a basic, functioning product. The most worrying thing I have read about Horizon Worlds, Meta’s social virtual reality experience, is that people inside the business don’t use it. “The simple truth is, if we don’t love it, how can we expect our users to love it?” rightly commented Vishal Shah, VP of Meta’s metaverse arm (1). He warned about complaints from users and creators that the product was “low quality and full of bugs”. And remember, this is after $27 billion of investment to date with a team of 10,000 engineers working on it. The second most worrying thing I have read is the cartoon-like avatar selfie of Mark Zukerberg which went viral earlier this year. “The metaverse is as dead as Zuckerberg’s cartoon eyes,” reported Fast Company in a damning article (7). “The worst part is not how bad this digital face looks, but the fact that it is a symbol of how badly Meta is managing expectations for the metaverse.”

Horizon Worlds: a far-out horizon?

On brand growth projects we use a concept borrowed from, I think, McKinsey, using planning ‘horizons’: H1 is short term (one to two years), H2 is medium term (two to three years) and H3 is long term (four to five years). The idea is to focus a good proportion of time and money on H1, say 60%. You also need to invest in H2 projects, say 30%. Finally, early investment is needed in longer term H3 projects, the remaining c. 10%.

The exact % splits will vary. But the main point is to focus on the core whilst also investing for the future.

In the case of Meta, my take is that Mark Zuckerberg’s passion for the metaverse, seen by some as an obsession, has led to an imbalance in investment of time, talent and money, with insufficient focus on the core and H1. “Mark Zuckerberg’s metaverse obsession is driving some current and former Facebook employees nuts,” is the way Business Insider described this problem. He is certainly heavily invested personally, with his fortune, largely tied up in stock, dropping by $19 billion this year, to a miserly $53 billion according to Bloomberg.

There is a chance that the metaverse will grow and become an important source of business in the future. But my bet is that McKinsey are wildly over-estimating the metaverse’s potential when they predict it “may generate up to $5 trillion in impact” by 2030″ (2).

Fishing where the fish are

Meta are investing billions to build a new virtual world in the hope that people will want to come. An alternative approach is to “fish where the fish are”, by partnering with companies who have already created virtual worlds. One example quoted in the press is Nike’s partnership with online gaming platform Roblox to create Nikeland. Roblox already has 164 million daily users (9). And, importantly, you can don’t need an expensive and cumbersome VR headset to play. You just use your mobile phone, PC or gaming console.”According to the brand, 6.7 million people from 224 countries visited the online space and taken part in online games while trying on virtual products,” (10).

Nike is the only brand to make serious money out of non-fungible tokens (NFTs), such as virtual sneakers for your Roblox character. It has made $185 million to date (11), miles ahead of the next brand Dolce & Gabbana ($26 million). Although this equates to only c. 0.4% of Nike’s annual global revenue.

All this said, building a virtual Nikeland inside Roblox isn’t really the metaverse revolution that Meta are investing billions to create. Nike’s approach is much simpler and close to that written about by brandgym partner David Nichols back in 2005, in the book he co-authored: Brands and Gaming. As one review of the book said at the time, 17 years ago, ‘This book leaves the reader in no doubt; computer gaming is a major new medium which marketers ignore at their peril.” Boy, you were ahead of the game David N. !

In conclusion, every company should be future-focused. However, brand and business strategy should inspire core revitalisation, not only the development of nascent new businesses. Time will tell if Zuckerberg’s all-out focus on the metaverse is a brilliant leap of faith or an example of a leader being distracted from the core at a time when competition was hotting up. My money is on the latter. And I expect to see a re-focusing back on the core in the next couple of years. Watch this space for an update in November 2023!

Sources: