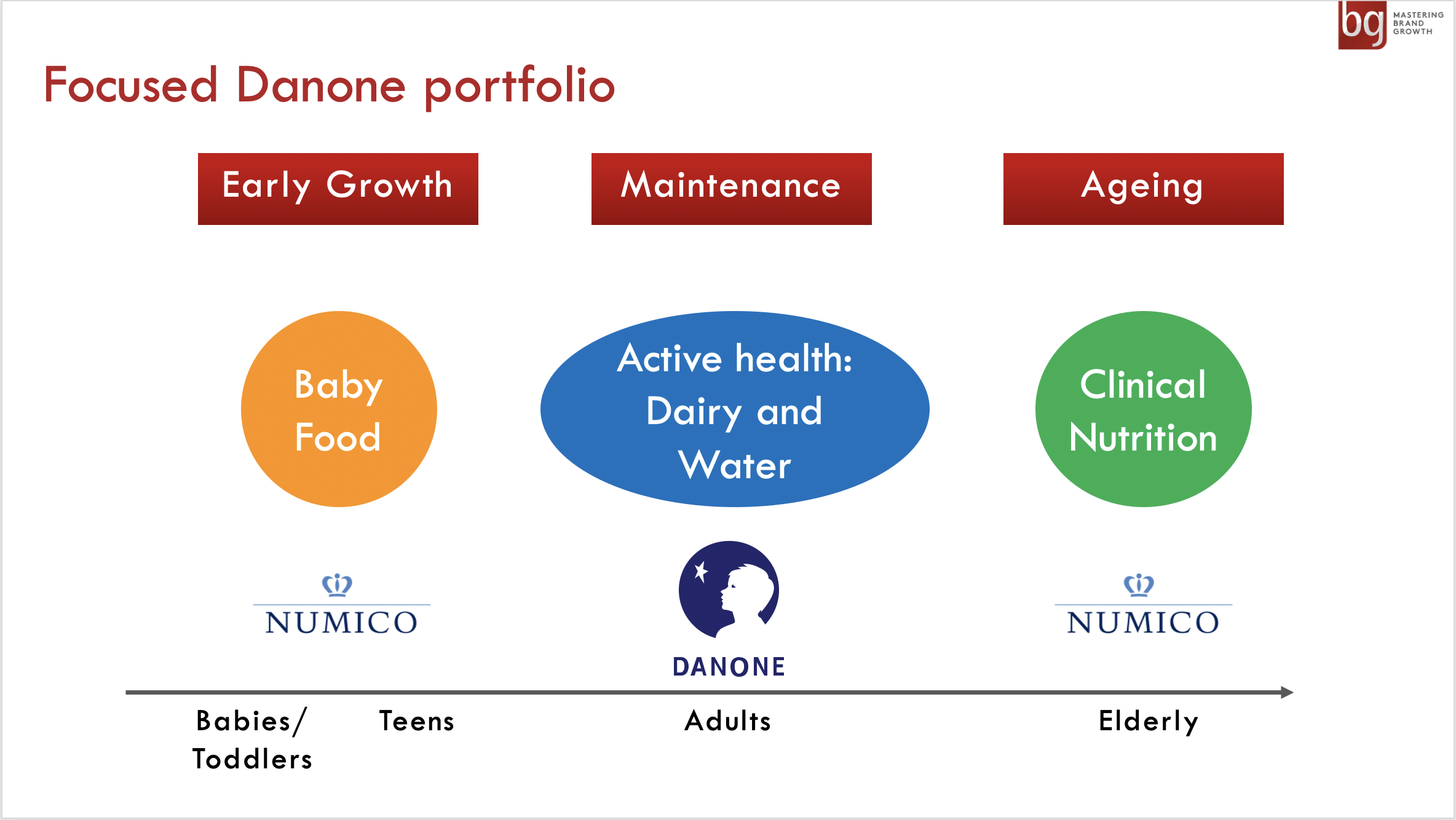

Danone’s transformation over the last 10 years is nothing short of remarkable. The latest and perhaps most significant episodes in this story is coming to a close now. They are selling their biscuit division to Kraft, and buying the Numico business which does baby food and clinical nutrition. Its a great exam of how to focus your portfolio.

Danone is now 100% focused on health, with a range of products that go from babies, through infants to adults and then people in later life. They are now only in fresh dairy, baby food, water and clinical nutrition:

Compare this to where they were a decade ago, which was your typical diversified food and drinks business, selling everything from beer to baby food. Since then, they have sold all the following which did not fit with their vision of “active health for everyone on earth”:

– 1997 – pasta, sauce and soup brands (Panzani)

– 1999 – frozen and chilled

ready meals (Marie Surgeles)

– 1999 – Container activities

– 2000 – Kronenbourg beer and share in San Miguel beer

– 2002 – Italian cheese and ham

(Galbani)

– 2004 – British biscuits (United Biscuits)

– 2005 – HP Foods

Talk about focus! The cash generated has been put behind not buying other companies, but on driving their big global brands such as Activia, Actimel and Vitalinea. Each of these has $1billion+ in sales now.

And boy does this work. Their organic growth in 2006 led the pack, reflecting the fact they have re-aligned their portfolio to be focused on markets that are i) high growth, ii) where they have real ability to win:

Danone +9.7% (almost double digit organic growth, in a consumer goods business!)

Nestle +6.4%

PepsiCo +6.0%

Coke +6.0%

Cadbury +5.5%

Unilever +3.8%

Kraft +1.4%

The comparison between Danone and Kraft, the seller and buyer of the biscuit division respectively, is interesting. Danone’s more focused business delivered six times the organic growth of Kraft in 2006. And check out the difference in share price performance over the last 5 years.

The Danone story is a powerful reminder of how you can drive growth by sacrificing (sell off businesses) and over-committing (re-invest in a smaller number of things).

For more insights on how to create a brand portfolio strategy, check out this earlier brandgym blog post: