This post looks at how marketers can respond to the ‘innovation squeeze’ introduced in last week’s blog: the dual demands of lower costs AND rapid innovation to drive topline growth. Two key challenges for big brands are speeding up the innovation process, breaking of a reliance on conventional quantitative research, and raising the game in pitching innovation to senior management.

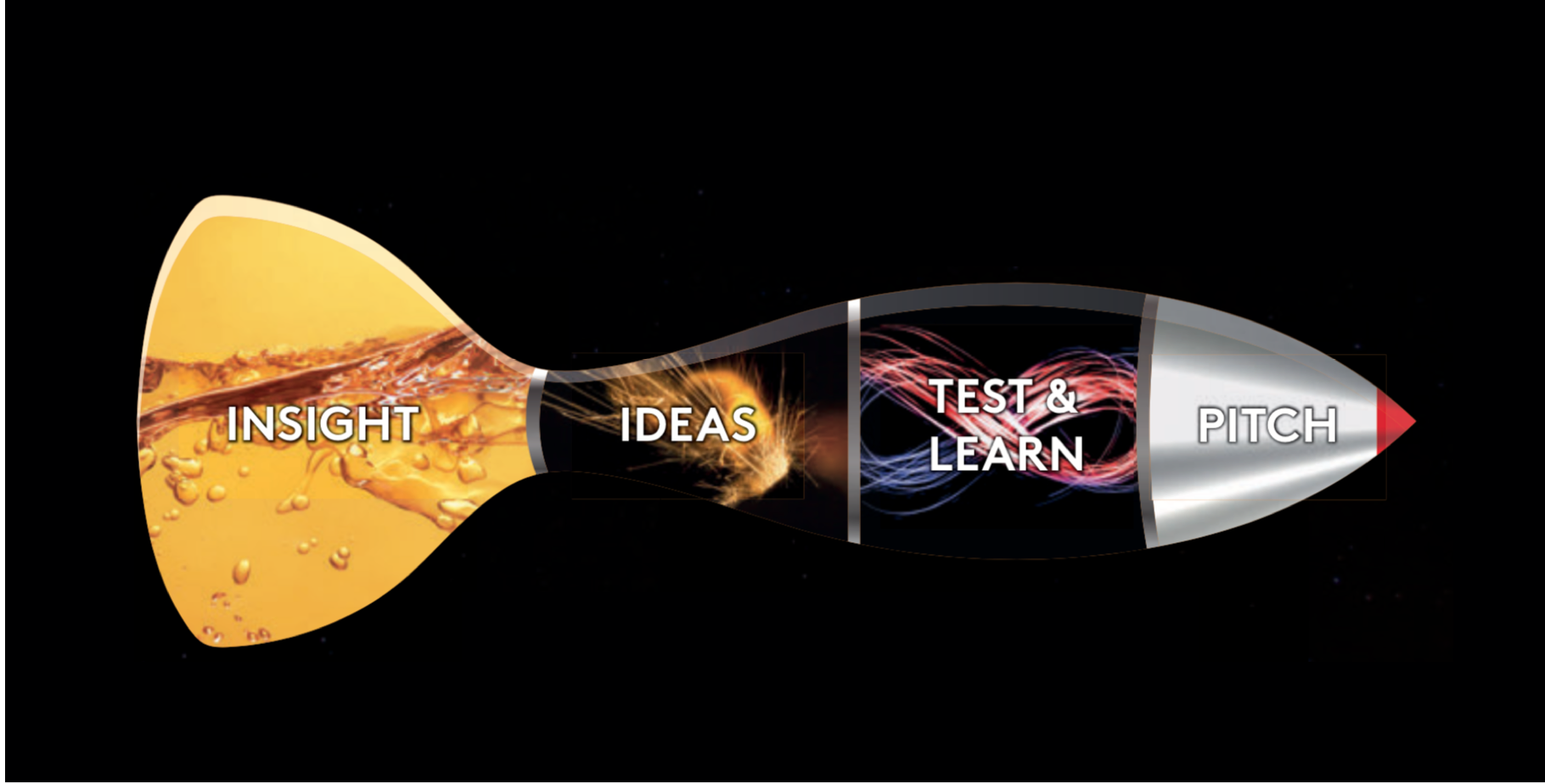

Below we look at an approach called ‘Rocketing’ (below), developed using inspiration from tech start-ups we mentor and invest in and harnessing digitally-powered insight to ‘re-boot’ the innovation process. This sort of approach allows big brands to accelerate the innovation process, saving both time and money. For example, an accelerated Rocketing process helped Pladis create a new chocolate brand, compressing into five days what would normally have taken months: from insight to ideas to product & pack prototypes, including consumer exploration. Lead ideas went straight into a rapid quant test, achieving a top 5* rating.

1. ‘Insight fuel’

The first opportunity to solve the innovation squeeze comes in the insight phase. Here, we partner with a network of new insight agencies using digital and mobile-enabled methods to save time and money on projects. For example, mobile phone video ethnography provided real time, multi-country insights into vitamin consumption habits on a recent project for a consumer pharmaceuticals company. And AI-enabled cultural analysis allowed the creation of 10 inspiring ‘springboards’ to jump-start innovation ideas for a beer brand in days rather than the weeks needed using a conventional approach.

And as covered last week, an inspiring brand positioning is a highly potent springboard for innovation, but one which almost half of companies are not using!

2. Ideas

There are opportunities to short-cut the process of creating and exploring innovation concepts during the ideas phase. ‘Consumer Jam’ sessions allow teams to get live feedback from multiple consumer groups in a single evening, with a ‘hot debrief’ happening the morning after rather than several weeks later as with conventional qualitative studies. And when harder, quantitative feedback is needed, fast online polling can be used to rapidly test ideas.

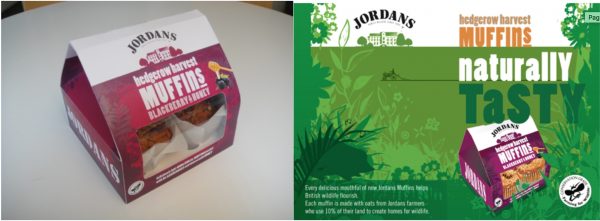

Despite all the talk about ‘agile’ marketing, only 1⁄2 of the respondents in our research rapidly explore rough ideas to ‘test & learn’, with limited budget to create & explore ideas is one explanation for this. We recommend spending a bit less on expensive research, and a bit more on prototyping ideas to bring them to life in real time: ‘think less, do more’ is a useful mantra here. For example, when Jordan’s cereals asked us for help with innovation ideas , we mocked up and delivered a box of Jordan’s muffins and accompanying advert in 24 hours.

New online quantitative methods allow much faster and cheaper evaluation of ideas. For example, Unilever’s Idea Swipe tool, inspired by Tinder, shows new ideas via consumers’ smartphones and asks them to swipe right/left if they like it/don’t like it. “The app delivers better quality data more quickly than older survey techniques, and it has tested about 5,000 ideas in 25+ countries since it was launched a year ago,” according to an FT article (1).

4. Pitch to win

We saw in last week’s post that marketers need to raise their game when pitching ideas to senior management. We encourage teams to break out of 100 page Powerpoint decks and act more like start-ups, who often have only five minuted to pitch an idea. ‘Beermat business plans’ force marketers to create a short, sharp but solid business case, and coaching helps create a compelling, inspiring story for senior management. For example, we helped the Royal Canin catfood team create 10 powerful, business-focused innovation pitches, going from ideation to senior management presentation in days, rather than the typical weeks or months.

In conclusion, re-booting innovation with digitally-powered insight, rapid prototyping and better pitching can help big brands save time and money, competing more effectively with smaller insurgent brands. And early signs suggest this approach may be paying off, with the top 30 global companies growing organic sales at 2.9% per cent last year according to Bain, the best performance since 2013. The big players “have upped their innovation game” and that it is now starting to pay off, as the head of Bain’s consumer practice observed.