Is Sky smart to stretch its brand into the smart TV market? I asked myself this question today, after seeing an ad for the new Sky Glass TV. Sky’s subscription TV offer is built into the Sky Glass TV set, instead of the normal proposition of a set-top box and satellite dish.

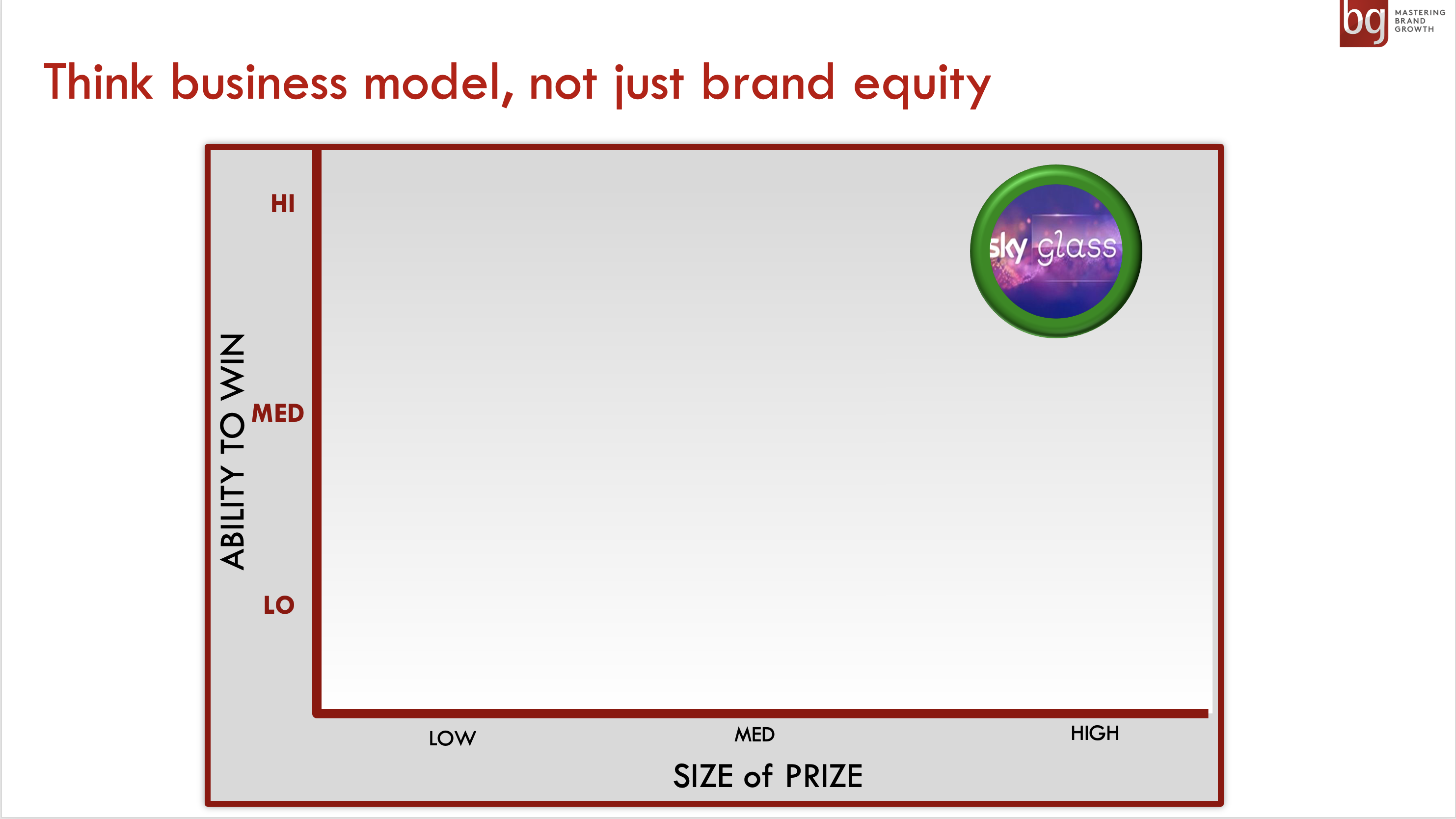

One question we could ask is, “Can the Sky brand stretch into the TV market?” But a better question is, “Can Sky make any money from stretching into the TV market?”. And to help answer this question, we’ll use a simple framework that we use our brandgym Mastering Brand Growth Program.

1.Size of Prize

The first thing to assess on any brand stretch initiative is the size of the prize. To do this, we look at 1. the size and growth of the market, 2. the appeal of the concept and 3. the product delivery.

Market attractiveness

The smart TV market looks relatively attractive, based on the data I could gather. Sales of TV sets grew 19% in 2020, the highest annual growth in a generation, helped by the lockdown effect (1). A total of 4.2 million 4K TVs were sold, which I estimate to be worth c.£2billion using an average price of £500. And smart TVs (connected to the internet) are growing rapidly: 67% of households have one in 2021, up from only 11% in 2014.

On the downside, Sky are going up against some pretty formidable competitors, who are smart TV specialists. Samsung lead the market with 31%, followed by LG (15%) and Sony (12%).

Concept appeal

In terms of concept, Sky Glass does seem to have strong appeal. For people considering subscribing to Sky to get its package of TV, sports and movies, Sky Glass offers more convenience. Gone is the need for a separate box and an ugly dish on your roof.

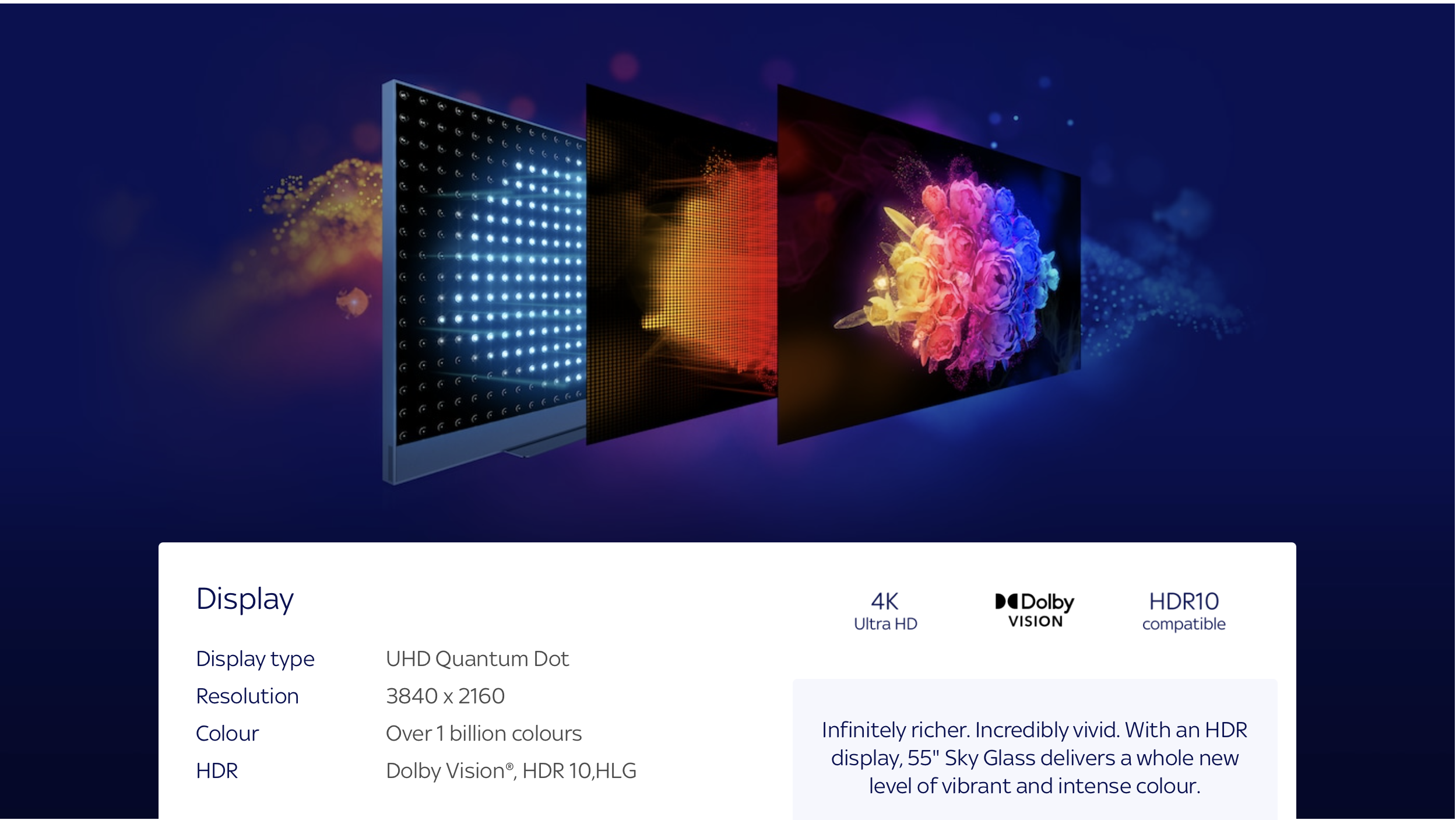

The product itself looks appealing. “On paper at least, Sky Glass talks an excellent game. It’s a 4K TV with both Dolby Vision high dynamic range (HDR) and Dolby Atmos sound, all of which you’ll find in top tier sets from LG, Samsung and Sony,” reports GQ (3). Sky Glass also claims to make viewing easier, by pulling in episodes, movies and live sport from most major broadcasters and streaming services.

And the TV is attractively priced, at £849 for a 55 inch version, with the option to pay £17 per month (over 48 months). You then pay on top of the Sky content package you want.

Product delivery

It’s all well and good to have a strong concept. But does the product ’sausage’ deliver? This is a key reason why an estimated 70% of brand stretch attempts fail. They work well on paper and in concept testing. Even the prototype products produced in perfect conditions look good. But, the reality of the actual in-market product often disappoints.

In the case of Sky Glass, the content and interface seem to perform very well. “The actual content and how it’s presented is impressively slick,” gushes GQ (3). “Despite the potential to overwhelm you with viewing options, you don’t need a galaxy-sized brain to figure out what you want to watch.”

The reports on the picture and sound quality are more mixed. “Unfortunately, Sky Glass just isn’t a particularly good television,” complains Wired (4). “True black itself is in short supply. It’s not especially bright.” However, the overall value proposition may still be compelling for a large group of people. “You’re getting a TV and a Dolby Atmos soundbar for just £849. That’s not a lot of money for a 55-inch TV of any kind, and a long way short of OLED money,” says What Hifi in a more positive take on the product’s delivery (5).

2.Ability to win

Marketers tend to be pretty good at estimating the size of prize for brand stretching. Where they often fall down is on assessing ability to win.

This involves first considering whether a company has the capabilities to actually make and distribute the new product. The Sky Glass panel is made by one of the world’s largest panel manufacturers, which is a good sign. And Sky do have experience of hardware, not just content, through their manufacturing of satellite dishes and set-top boxes. Time will tell if they can produce smart TVs in the right quantity and to the right quality.

In addition, we need to assess the ability to invest in the new product, not just at launch, but for the long run. Sky are picking a battle with brands for whom smart TV is one of their core businesses. So, they need to be ready for a long, hard and expensive battle. On this count, Sky seem ready to invest significantly. Sunny Bhurji, Sky’s marketing director, plans 18 “hardcore” months of spend to bring to life “the UK’s biggest-ever product launch”, according to The Drum (6). The Sky team are clearly focused on driving penetration, aiming to each 99.9% of the UK population!

3.Growing the core

The final thing to consider is the impact of the brand stretching on the core business. We’ve posted many times on the risks of brand stretching to distract both money and talent away from the core, such as this post on Innocent Veg Pots.

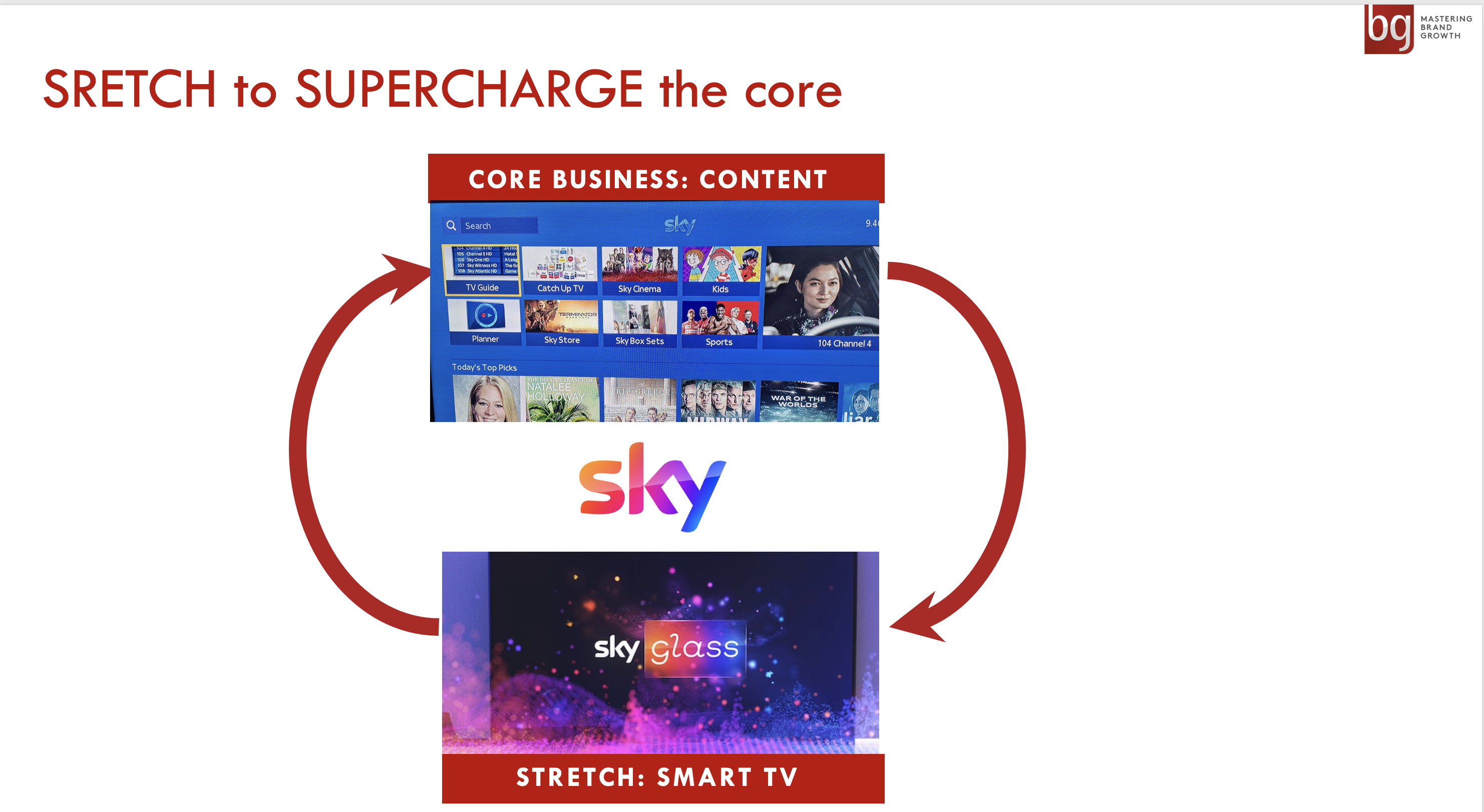

As a minimum, you want a sizeable and incremental and profitable new revenue stream. But best of all is a stretch that actually grows the core by creating what I call a ‘brand ecosystem’. One example I posted on here is the stretch of Netflix from streaming into content production. Not only does this create a new business. It actually supercharges the core by making the streaming offer more appealing.

And Sky Glass has the same potential to supercharge the Sky’s core content subscription offer in the long term. For people considering subscribing to Sky, the new offer could persuade them to become a Sky customer. And for people looking to buy a new smart TV, they could be attracted by the value proposition of Sky Glass and end up subscribing to Sky, thus driving penetration. However, the limited supply of Sky Glass means at launch it is only available to long-term customers. This is a missed opportunity in my book, as penetration is the key to brand growth.

In conclusion, when looking at a potential brand stretch opportunity, the above 3-step framework can help you assess the chances of success. In the case of Sky Glass, I rate the changes of brand stretch success as pretty good. Higher on size of prize, with lower ability to win based on questions about manufacturing and distribution capability. We’ll check back in a couple of years to see how smart Sky’s stretch turns out to be.

To further explore how to strategically stretch a brand, we cover this topic in depth on the brandgym Mastering Brand Growth program, hosted here on our brandgym Academy online learning platform.

Sources: