This is the first of two posts sharing insights from our 17th annual research project on what we call “The Core Growth Crisis”. The research used a quantitative survey of 100 senior marketing professionals across the globe covering different sectors. We explored the challenges of growing the core in today’s difficult economic context of global economic pressures, including the cost of living crisis. Specifically, we looked at the role of core brand growth versus innovation to stretch into new markets.

This first of two post looks at the importance of growing the core, its key benefits and the major challenges.

Core growth remains important…

The key role of growing the core is confirmed by our survey: 85% say it is the best way to create sustainable, profitable growth, compared to only 15% for innovation. In addition, 91% said that growing the core had become more important in the last three to four years.

The benefits of growing the core are clear. First, growing the core reinforces what made your brand famous, strengthening the “distinctive memory structure” that helps you stand out. Second, core brand growth focuses time, talent and money on the biggest, most profitable growth opportunities. A recent example is UK supermarket Sainsbury’s decision to withdraw from banking and focus on their core food retailing business.

… but the core is facing a crisis

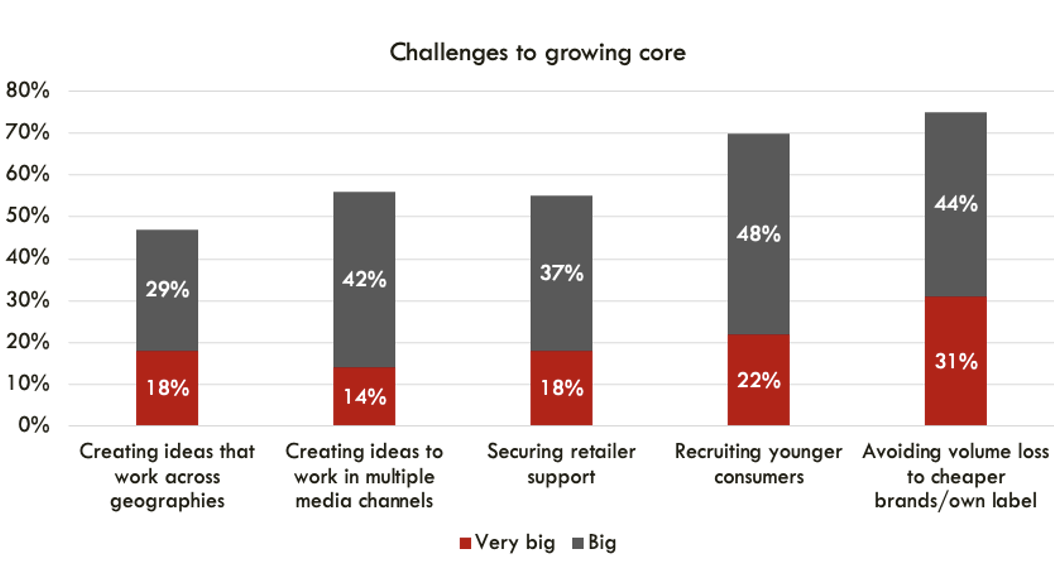

Whilst marketers are clear on the importance of the core, growing it today is very challenging. The biggest core growth issue is avoiding losses to cheaper brands inc. own label (see below).

Many brands have relied heavily on pricing for growth in recent years, leading to a widening price gap versus cheaper brands. For example, P&G grew revenue but lost volume for the past seven quarters. ”A shift in consumer preferences in response to inflationary and cost-of-living pressures” is also reflected in growth of discount retail brands like Dollar Tree (US) and B&M (UK), according to Brand Finance. Volume losses have created a “core growth crisis” in many companies, with Unilever laying off thousands of employees and General Mills also suffering slowing sales (see side bar).

Given the challenge from lower priced band, companies today need to focus on also creating volume growth by driving penetration. “Growth is still the imperative, but getting it from brilliantly executed pricing is surely coming to an end,” commented Mark Ritson in a recent Marketing Week column (1).

Key challenge 1: Hard to convince CUSTOMERS

The majority of marketers view the core as the best way out of the growth crisis. However, only 30% of retail customersshare this belief (-13 pts vs our 2013 survey), with a resulting lack of support from for the core from the sales team (see below).

This shows the need for a “total business” approach to growing the core that engages the wider business, especially sales. WD-40 Company is an example of taking a company-wide approach to growing the core. Over 200 people have been trained on core growth, covering all functions, including sales, HR and supply chain, from the board down. Core growth is the focus of the company’s 4 “Must Win Battles”, with initiatives including multi-siting and display in-store, sampling and new pack formats like Smart Straw.

Key challenge 2: Hard to get FAIR SHARE of FUNDING

This lack of alignment on the importance of the core is reflected in a struggle to get a fair share of investment for growing it. Whilst two thirds of respondents say the core has been the main source of growth in the past 2-3 years (see below), only 31% say that it has been the main focus of investment. This suggests that re-focusing someinvestment onto the core could drive stronger growth.

Key challenge 3: Hard to DO

Once a company has decided in principle to grow the core beyond pricing alone, the next challenge is that doing this in practice is hard to do.

First, it a mere 18% say it’s easiest to find advice on growing the core versus 92% for innovation. This is shown by our book Grow the Core still being one of only two on the subject on Amazon, compared to 60,000+ on innovation! Here, there is a need for leaders to invest in training and capability to equip teams with the principles and tools to grow the core.

Second, getting teams motivated to work on the core can be challenging. Innovation is still seen as more cool and exciting by 92%!. It is also viewed as the best way to get rewarded and promoted (66% vs. 34% for growing the core). Here, marketing leaders need to drive a change in culture to show how core growth can be exciting and a way to get ahead. Liquid Death shows that growing the core can be cool and exciting. It turned the water category on its head through an obsessive focus on having a distinctive core product and packaging, as we posted on here. “The only way the brand would have a chance of survival is if the actual product itself was insanely interesting,” as founder Mike Cessario stated.

In conclusion, growing the core is more important than ever, with clear brand and business benefits. However, core growth is facing something of a crisis. Next week, we look at the bold action needed to engage cross functional teams and then equip them with tools to drive core growth, beyond pricing alone.

You can explore GROWING THE CORE in depth on the short, on-demand course on our brandgym Academy platform here. The course is fully refunded if you go on to take the full brandgym Mastering Brand Growth program, where we explore a comprehensive and practical 8-step program for creating brand strategy to inspire business growth.

SOURCES